? ATTENTION:

*If You’re Leaving Your Family’s Future to Chance, You’re Risking Everything.*

Let me ask you a question:

*When your family’s future is on the line, would you trust it to just anyone?*

The truth is, most insurance agents sell policies. **I build Connected unshakable legacies.** And I don’t do it alone.

**Why that matters for YOU:**

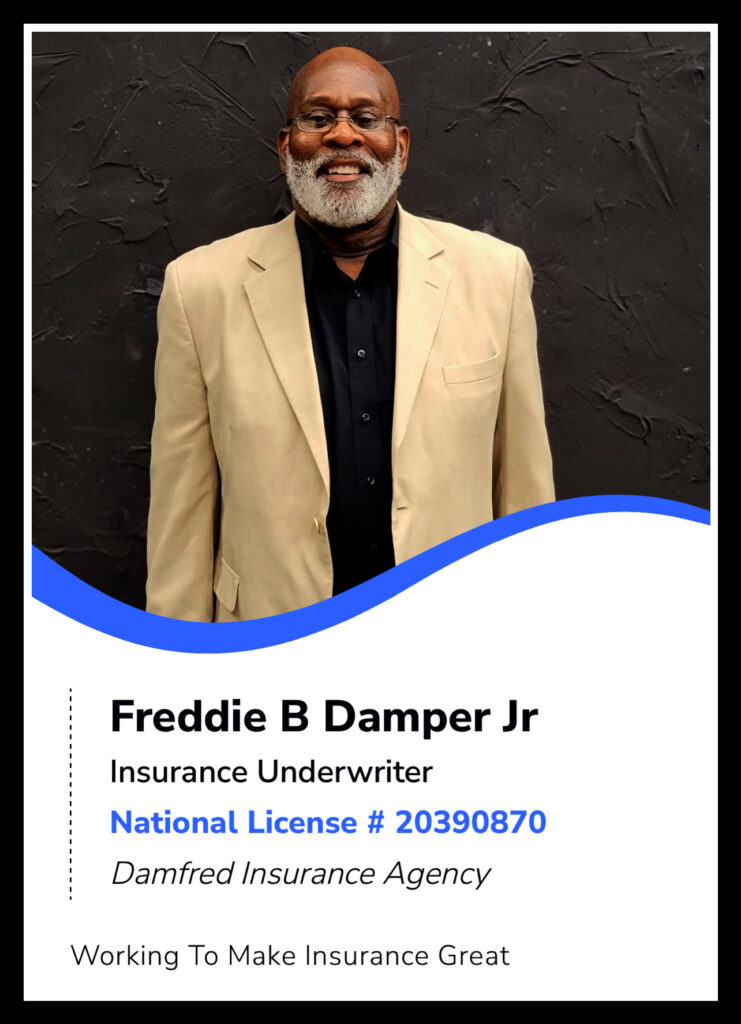

National License # 6617029

I'm Taq’uee Hicks**, and I partner with families and entrepreneurs to transform uncertainty into **#GenerationalWealth** But here’s the difference:

**I’m backed by the most knowledgeable experts in the industry**—actuaries, financial strategists, and legal advisors—who work *behind the scenes* to fortify your plan.

Meet my long time business Connection, Fred:

– **We are contracted exclusively with A-rated insurance carriers**, the gold standard for financial strength and reliability. No shaky startups. No fine-print surprises. Just proven stability.

This means your family gets **bulletproof protection** designed by the best minds and backed by the most trusted names in the business.

**THE PROBLEM**

Most families are *one crisis away* from:

– ❌ Drowning in medical debt.

– ❌ Losing their home.

– ❌ Leaving their children’s future to luck.

And the worst part? **They thought they were “covered.”**

**THE SOLUTION**

**I don’t just sell insurance—I engineer Connected Legacies.**

With my **dual advantage** of **industry-leading expertise** and **top-tier partnerships**, here’s what we’ll do:

1. **? DIAGNOSE RISKS YOU DIDN’T KNOW EXISTED**

My network of experts will analyze your unique situation—career, health, debts, goals—to expose hidden vulnerabilities.

2. **? DESIGN A TAX-advantaged, FUTURE-PROOF PLAN**

Leveraging A-rated carriers, we’ll secure policies that *grow with you* and shield your assets from market crashes, lawsuits, and inflation.

3. **? TURN YOUR LEGACY INTO A LIVING, BREATHING FORCE**

4. ** CONNECT YOUR LIFE LEGACY INTERNALLY AND ETERNALLY**

**From college funds to charitable trusts, we’ll ensure your values—not just your valuables—outlive you.

WHY ME?…

✅ **DIRECT ACCESS TO ELITE ADVISORS**

My team includes 30+ year industry veterans and Nobel laureate economists. *Their brainpower becomes your advantage.*

✅ **A-RATED CARRIERS ONLY**

Companies like Mutual of Omaha, Foresters, etc. back your policies—the same institutions trusted by Fortune 500 CEOs and policymakers.

✅ **ZERO ROOKIE MISTAKES**

Most agents “guess” at coverage. I use military-grade risk-assessment tools honed by my expert network and your privacy is a priority, plus…

AUTHENTIC CONNECTION

**Here’s What I Do Differently:**

✅ **No cookie-cutter plans.** Your family’s story is unique—your protection should be too.

✅ **I fight for your peace of mind.** From debt to college funds, I secure the pillars of your legacy.

✅ **24/7 Partner, not a salesman.** I’m here *long after* the paperwork is signed and…

WE ARE CONNECTED FOR LIFE & BEYOND.

**Real Talk: What’s at Stake?**

– The home your kids grew up in.

– The dreams you’ve sacrificed for.

– The generational wealth that could vanish overnight.

**This isn’t just insurance—it’s a lifeline.**

**FREE LEGACY BLUEPRINT SESSION ($200 VALUE)**

*In 45 minutes, you’ll get:*

– A clear snapshot of your current coverage gaps.

– A customized strategy leveraging A-rated carriers.

– Answers to your toughest “What if?” questions.

—no scripts, no sales tactics, just raw truth.*

Taq'uee Hicks

*Licensed Insurance Professional | Partnered with A-Rated Industry Titans*

**“Legacy Isn’t Inherited—It’s Built. Let’s Build Yours.”**

? **“Lock In My A-Rated Plan”**

? **“Claim Free Blueprint”**

? **“Call Taq’uee: 1-916-800-4624”**

*You don’t get a second chance to protect your first legacy. Let’s get it right.*

If you're unsure of what legacy you are here to leave, I can help with that too…

RECAP:

**I work directly with the industry’s top #InsuranceExperts**—actuaries, estate planners, and Nobel-caliber economists.

– **Exclusive access to #A_RatedInsurance carriers** —the same ones trusted by Fortune 500 CEOs.

This isn’t just insurance. **It’s a lifeline for your #FamilyFirstPlanning.**

**#DontWait to Engineer Unshakable #FinancialSecurity**

✅ **#TrustedAdvisor Backed by Elite Connected Minds**

My network includes Nobel economists and legal strategists—*their genius fuels your plan*.

✅ **#A_RatedInsurance Carriers Only**

No shaky startups. Just companies with 100+ years of claims-paying strength.

✅ **#SmartParents Don’t Guess—They Plan**

I use military-grade tools to calculate risks, so your family’s safety net is *mathematically unbreakable*.

“Just Go!” Don't Stop

P.S. Download this FREE audiobook. You can thank me later!…

IAMCONNECTEDLEGACY.COM

follow and like us:

4 Comments

Laura

February 25, 2025 at 10:19 pm

This article offers some great insights into reshaping our lives and creating a better future. I found the part about shifting our mindset particularly compelling. In your experience, what’s typically the biggest obstacle people face when trying to rewrite their future? Also, what advice would you give to someone struggling to maintain motivation during this process?

Digital Wisdom

February 26, 2025 at 2:34 am

Great question!

Creating and building a family legacy with life insurance is a thoughtful way to ensure long-term financial security, but keeping the family motivated and engaged in the process is crucial. Here are some strategies to keep the family motivated throughout the process:

1. **Clearly Define the Legacy Vision**: Start by having a family discussion about what kind of legacy you want to build. Make it personal and meaningful. Whether it’s funding education for future generations, supporting charitable causes, or ensuring financial security for family members, being clear about the vision helps everyone see the bigger picture.

2. **Involve Family Members in the Planning**: Engage your family in the process. Let them understand how life insurance works and how it will benefit them. Encourage their input on the long-term goals and values behind the policy. This can foster a sense of ownership and responsibility for preserving the legacy.

3. **Educate About the Benefits (WE can help with this)**: Sometimes, the concept of life insurance and its long-term benefits can be hard to grasp. Help your family understand how it works, the advantages it provides (such as tax benefits, financial stability, and wealth transfer), and how it will positively impact them. Knowledge and understanding can inspire commitment.

4. **Celebrate Milestones**: Set achievable milestones and celebrate when they are reached. For example, when a policy is fully funded, or a certain goal related to the family legacy is achieved, make it an event. Acknowledging progress keeps motivation high and reinforces the importance of the legacy.

5. **Incorporate the Family’s Values**: Link the legacy and life insurance plan to the family’s core values, such as education, health, or community support. When family members see that the insurance isn’t just about financial security but about a broader, value-driven mission, they will be more likely to stay motivated.

6. **Set Up Regular Check-ins with your agent (preferably me)**: Schedule annual or semi-annual meetings with the family to review the life insurance plan and the progress of the legacy. This keeps the plan in focus and reminds everyone of the purpose behind it.

7. **Share Success Stories**: Highlight how other families have benefited from having a life insurance policy that created a lasting legacy. Sharing real-life examples of how life insurance transformed a family’s future can be both motivating and reassuring.

8. **Engage Professional Advisors**: Bringing in a trusted financial advisor (like me) to explain the policy’s benefits and how it ties into the family’s broader financial goals can help your family understand its importance. A professional can also ensure the policy is structured effectively for the long term.

9. **Create a Legacy Document**: Document the legacy plan and its significance in a way that can be passed down to future generations. This can include a letter or a family history that explains why life insurance was chosen as a tool for building the family legacy, keeping everyone aligned on the mission.

By making the process engaging, educational, and connected to the family’s values, you can inspire a deep sense of motivation to uphold and preserve the legacy for years to come.

“Just Go!” Don’t Stop.

Herman

February 25, 2025 at 10:40 pm

“Wow, this article really made me think! Taq’uee, your approach to legacy planning goes beyond the typical insurance pitch—it’s about building something lasting and meaningful. I love how you focus on creating a tailored, bulletproof plan backed by industry experts. One question I have: For families who may feel overwhelmed by the complexity of financial planning, how do you simplify the process to make it more approachable?”

Digital Wisdom

February 26, 2025 at 2:22 am

Thank you for your comment. To answer your question, my Free Legacy Building Blueprint does all the haevy lifting for you. Your family’s hardest task will be deciding how you want your financial future to be. Like coloring by numbers. “Just Go!” Don’t Stop